(Warning, I really boast allot about myself in this article)

I started blogging about 2 months ago. The industry has taken me by surprise. Maintaining a blog, I can really showcase some of my most unique talents and passions.

I learned that I really love to write. While I may not be the most eloquent writer, I really enjoy putting pieces together. Not only do I really want to help people do something better, but I love discovering unique ways of getting that message out there. Discovering more and more ways to let this my message escape is why blogging is so much fun for me. Over time, I will become better and better at relaying the messages in my head.

On top of my passion for writing, I have a unique talent for broad engineering. I love to see how things come together. When I was a kid, I took apart my Teddy Ruxpin in hopes of discovering how it worked. And I didn't stop there. I took apart my race cars, video games, lawn mower, and VCR. I sifted through the garage, putting nuts with screws, trying to create my own toy. I zoomed through the topic of Math. I loved to be the first one done with our tests in elementary school. I joined our Young Astronauts Program, thinking one day I may go to the moon. In high school, I started studying computer science. This took the cake. Once I learned how to manipulate computers, I was addicted to coming up with unique ways of solving problems. This passion continued into college. So now, as a blogger, I found a way to exploit some of that passion and talent. I could design and build a unique page. I can carve out my space in the virtual world.

In addition to my engineering exploration, I have a passion for art. It's not enough to pastel and sketch, I really love putting together Photoshop pieces. I'm not too good at it, but I really love doing it in my spare time.

Combining all of these, I am really, by my own judgment, the perfect candidate for a blogger. And the good news is: the blog industry is hiring. The internet is a limitless marketplace. It's space reaches out to infinite realms. Everyone will one day have access to its marvels. Fortunately, that day has yet to come. There is a lot more money to be made on the internet. I predict that Google and Yahoo haven't even seen 70% of their biggest profits yet.

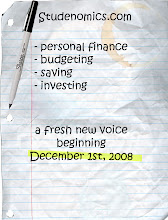

With that said, I'd like to announce that I am building my first unique web page. I am moving on beyond the constraints of Google's Blogger to a place where I can really exploit the internet in some more unique ways. I have really enjoyed my run here, and I really recommend Google's Blogger to the casual blogger. On the other hand, if you are going to take it serious, it may be a little more appropriate to create your own page from scratch. Not only do you get to really learn what you can do with your site, but you can also truly bring about a unique voice. So that's what I'm doing folks. I'm just now diving into the process full throttle. I don't however have an accurate estimate of how long it'll take to get my site up and running. I will be working on that more and more, so hopefully it won't take too long. I will leave MFF up for forever, because I really do believe in some of the content here.

My new site is located here. It's called "Blueprint Economics". Until it is completely up and running, I will continue to add to MFF. I will be announcing a launch date soon. Wish me luck.

Friday, November 14, 2008

Wednesday, November 12, 2008

The Economic Crisis Isn't Effecting Me

There's a lot of discouraging news out there. With all of these fear-driving forces in work, I still find it hard to find where the economy is effecting me. My adult life started in this economic environment, so my finances have been automatically adjusted. Groceries seem expensive, but I really don't know any better. I don't have a mortgage or a business, so my rates aren't going up. The only part of my life controlled by a rate are my credit cards, and I don't use them much. I've been working on my credit, but I'm really not ready to buy a house (look at my savings). I have a steady job, and so far it's kept me busy. It's not as busy as it was 2 years ago, but it's steady. I suppose I'm lucky that I haven't gotten laid off.

I know that I'm not recession proof, but I honestly haven't felt the pain yet.

I'm not trying to boast at all, but sometimes I wonder, what's the big deal?

How is the current economic crisis affecting you?

Labels:

economy,

personal finance

Tuesday, November 11, 2008

3 Steps To Getting What You Want

I am a firm believer that everything is determined by philosophy. Any and everything can be accomplished if you have the right philosophies behind it. And if you lack the right philosophies, though you may shine briefly, your fall is an inevitable outcome. Additionally, I believe that philosophies can be shaped and molded at any moment, but the best philosophies should be held closely for a long while to experience true fruition. So, while the title of this article may seem simple at first glance, the difficulty behind it doesn't lay in its understanding, but in its implementation.

I am a firm believer that everything is determined by philosophy. Any and everything can be accomplished if you have the right philosophies behind it. And if you lack the right philosophies, though you may shine briefly, your fall is an inevitable outcome. Additionally, I believe that philosophies can be shaped and molded at any moment, but the best philosophies should be held closely for a long while to experience true fruition. So, while the title of this article may seem simple at first glance, the difficulty behind it doesn't lay in its understanding, but in its implementation. There are 3 steps to getting the things that you want.

The First Step - The first step seems elementary, yet it is commonly overlooked. In order to take control of your life, you must identify how you want to live it. The first step to getting what you want is to decide what it is that you want. Additionally, keeping this one important thing floating in your head is about as effective as telling yourself that you want to go to Mars. You must articulate it in some way. Your mind doesn't separate daydreams from actual goals until you write it down. This study says that only 15% of people actually do this. No wonder the super-rich are so thin in numbers, because most people are skipping the first step.

Picture this initial move toward getting what you want as a question. In a sense, you are asking the universe to come together to help you accomplish your goals. There are some people who believe that you can attract the things you want out of life just by thinking about them. "Like attracts like" in their eyes. I believe that this rings true. If I think about getting into an accident all of the time, you can bet that I will eventually get into an accident. That equation still works with more positive situations. If I simply think about a more positive life, in specific ways, those positive events will find their way to my doorstep.

The Second Step - The second step, while it may seem easy, proves to be the most difficult part of the process, because it requires some leaps of faith. The second step to getting the things that you want is to simply believe. Believe that you have the ability to accomplish your goals. Believe that things will universally work in your favor. Believe in your vision. This step is difficult because, you have to invest in the unseen. The leap of faith it takes to believe that you will own a $9 million home is hard to maintain if you are used to living in a trailer. It is hard to believe that you can be financially free, if you have $80,000 in unpaid credit card debt. So while this step seems easy, it is the most difficult part of the process. I'm afraid there's no way around it though.

The second step may be the one and only reason why people don't even try to live their dreams. Without belief, most people won't even take the first step. Those that have accomplished their dreams never doubted in their abilities. I was watching an interview on CNN with Ted Turner. The reporter asked him if he could think of anything that he wanted to happen in the world that would not happened. Ted Turner, the seasoned visionary, looked dazed and confused. He truly found it hard to think of something in the world that would not go his way. After some self-debate, he finally said "winning an NBA Championship." (Ted Turner no longer owns the Atlanta Hawks) He is a pro at accomplishing step number two. He simply believes that everything he puts his mind to, he will accomplish.

Once you've tackled belief in your dream, inspired action will inevitably follow.

The Third Step - "Act as if . . . ". You must feel, and act as if you have accomplished your wildest dreams. You must feel like a winner, to even have a chance at winning. You don't become 'rich' once you've attained money. You become 'rich' once you've decided to live your life toward that goal. You must act as if you are on the absolute correct path to accomplish your goals. If you really think about it, you are. If you are to ever accomplish anything further in life, you will have to do it from where you are right now. So why not act as if you have the most phenomenal life ahead of you.

It's funny how you're actions change once you've decided where you are going.

These three very basic steps can change your life. If you take this approach to getting the things that you want, I have no doubt that you will accomplish your goals. People are so lost in life most of the time, that they forget to ask: How can I make my life the way that I want it to be? The steps outlined here are efficient enough to intrude on the busiest of schedules.

Labels:

personal finance

Monday, November 10, 2008

An Apple a Day / An Hour a Month

An apple a day keeps the doctor away. An hour a month can eliminate debt and leave you financially free. I know it doesn't rhyme, but the statement rings just as true. Allotting an hour each month to reevaluate finances has incredibly changed the face of my financial situation. I'm going into only my 3rd month of continually practicing this, but I've already seen drastic results. Here are some reasons why.

An apple a day keeps the doctor away. An hour a month can eliminate debt and leave you financially free. I know it doesn't rhyme, but the statement rings just as true. Allotting an hour each month to reevaluate finances has incredibly changed the face of my financial situation. I'm going into only my 3rd month of continually practicing this, but I've already seen drastic results. Here are some reasons why. 1. Evaluating my bills - The first month that I incorporated this into my schedule, I took a close look at my bills. I'm already pretty organized, so paying my bills on time isn't a huge problem for me, but for some of us that hour can be used to get a jump on when your bills are due in the upcoming month. Continuing to look at my bills, I noticed some places where I could save some money. I shrunk my cell phone bill, saving around $40 a month, by adjusting to a more fitting plan. I also switched my car insurance, which led me to saving over $1600 a year. I couldn't believe how much I was overpaying. Why didn't I do this earlier? Simply making these two small adjustments to my bills saves me over $2000 a year.

2. Where's all my money gone? - Sitting down and taking a look at my income and my expenses, I couldn't help but wonder: where has all the money gone? I had committed to saving $150 per pay period, but there seemed to be so much more money left unaccounted for. Where was it going? I realized immediately that my financial defense needed some work. I noticed that I pulled my debit card out often, and for the most part it was for food. Does eating out really cost that much? It turns out, that it does. I had developed a habit of eating out nearly three times a day, and until I evaluated my finances, I never realized how much this drained my income. After that first evaluation, I made a commitment to grocery shop, and to stop eating out entirely. This one decision saves me over $2,340 a year. You really have no idea how much you can save until you stop for a second, and take a look at what you are doing with your money.

3. What can I do with all of this extra money? - This is a very good problem to have, but at some point on your way to financial bliss, you must decide how you are going to handle your excess money. I didn't reach this question until my third evaluation. At that point, you can decide on a monthly basis where you are going to allot your money, whether it be stocks, IRA, a 401k, ect. I personally have opened an E-trade account. Let's just say the talking baby got to me. I'll be putting my extra income into this account in the upcoming month. Maybe you have some debt that you can pay off. Within that hour, you can make a conscious decision of where your money will end up.

4. What can I afford? - After a couple of months, you will get a good sense of what you can afford. For me, there's no more spending $75 at Best Buy on splurges, and random spurts at the mall. My money stays where it is supposed to, because when I look at it, it has more value to me. Once I started evaluating my money, I grew this huge attachment to the money that I earned. All of a sudden, it wasn't as easy to spend so carelessly. I somehow grew a sense of what I could afford, just by taking a look at my finances once a month.

My finances have seen a complete transformation since I've started evaluating once a month. And I honestly spend about half an hour per pay period, which occurs once every two weeks. You can see the changes that have happened for me. Just the simple changes that I have made, save me over $4300 a year. That's incredible! I encourage everyone to practice this habit. Spend just one hour a month, and take a focused look at your past and future finances. Evaluate your goals for the upcoming month, and provide some self-constructive-criticism to the previous month. Just an hour a month has had some tremendous results for me.

Labels:

personal finance

Saving Money in a Young Relationship

Now that I have gotten to a point where I can wrap my mind around my financial situation, I can see where there are holes in my defense. By holes, I am referring to instances where I am spending more money than necessary. A hole in my defense, for example, occurred, when I received my cell phone bill, and I had gone over. My bill, which I had planned to pay at $112, came to $165. This is a major hole in my defense. A couple of months ago, I switched my plan from the "all you can eat", unlimited plan, to a more affordable plan, and I guess I'm paying the price for it this month. My lack of concern regarding my minutes led to a hole in my financial defense. This is a small lapse when compared to how much I spend on my girlfriend.

I love my girlfriend very much, but our relationship is now my highest expense (excluding my basic bills and considering I've cut out spending eating out) If we aren't going to the movies, then she wants to go to a comedy club or out to the bar with her friends. She is constantly bombarding my life with her constant demands of my time and money. My wallet is screaming out for help nearly everyday. How could I ever get to the top without the frugality that she so clearly lacks. She can spend more money in 30 minutes than I make in a week. I am probably exaggerating a bit here, but the concern still exists regardless.

I love my girlfriend very much, but our relationship is now my highest expense (excluding my basic bills and considering I've cut out spending eating out) If we aren't going to the movies, then she wants to go to a comedy club or out to the bar with her friends. She is constantly bombarding my life with her constant demands of my time and money. My wallet is screaming out for help nearly everyday. How could I ever get to the top without the frugality that she so clearly lacks. She can spend more money in 30 minutes than I make in a week. I am probably exaggerating a bit here, but the concern still exists regardless.

Obviously, I'm learning to better handle my expenses, but at the same time, I want to spend quality time with my girlfriend. Not spending money is a little far-fetched, but I came up with some ways that you can save money on those ever-growing relationship expenditures.

1. Red Box - This little thing was the best invention of the new millennium. Aside from their convenient locations, they offer the best deal for movie rentals available. While you are at the grocery store (saving money cause you're not eating out), you can stop by these wonderful machines and get new rental DVDs for just a dollar a night. Coupled with a cool recipe, you've got yourself a cheap dinner and a movie.

2. Local Attractions - Nearly every city has somewhere for you to go and take a walk or browse for free. If you can get past the gas prices, you can find cheap accommodations in your back yard. Not to mention how caring and thoughtful your girlfriend will consider you for making the suggestions. I'm from the DC metropolitan area, so we have monuments and museums at our fingertips to (freely) explore.

3. Just above fast food restaurants - If you must eat out, consider your options. I don't know about all girls, but my girlfriend is just as happy eating at Chipotle, as she would be eating at Ruby Tuesdays. Find restaurants where you serve yourself, like Panera Bread or Noodles and Company. These are great places that are a little better than fast food, but not as pricey as a dine-in restaurant. Budget right and save the nicer restaurants for special occasions. Not only will you save money, but then your special occasions are actually "special".

4. DVR - If you have cable, I'd suggest a DVR box. I'm not a huge TV-buff, but having shows, that both my girlfriend and I can tolerate, readily available helps for us to find a common ground when we stay in the house. And the more time we spend in doors, the less money is needed.

5. Video Games - I know this sounds weird, but finding a game that both you and her can enjoy leads to hours and hours of entertainment. I spent $100 on Rock Band, but we've spent a countless number of hours playing it together on the weekends with friends, when we could be out spending money at bars.

6. Drink in - At our age, we still go out regularly. Although, I'm usually the Designated Driver, I'd suggest that if you are going to drink, drink in. You can mix drinks at your house, and a drink that would've costs you $12 can now cost you $3.

Whatever you do, the most important part of the process is communicating to your partner what your financial goals are so that you can work together toward the cause. If you just use a little creativity, you can still have a very spicy relationship without spending as much on it.

I love my girlfriend very much, but our relationship is now my highest expense (excluding my basic bills and considering I've cut out spending eating out) If we aren't going to the movies, then she wants to go to a comedy club or out to the bar with her friends. She is constantly bombarding my life with her constant demands of my time and money. My wallet is screaming out for help nearly everyday. How could I ever get to the top without the frugality that she so clearly lacks. She can spend more money in 30 minutes than I make in a week. I am probably exaggerating a bit here, but the concern still exists regardless.

I love my girlfriend very much, but our relationship is now my highest expense (excluding my basic bills and considering I've cut out spending eating out) If we aren't going to the movies, then she wants to go to a comedy club or out to the bar with her friends. She is constantly bombarding my life with her constant demands of my time and money. My wallet is screaming out for help nearly everyday. How could I ever get to the top without the frugality that she so clearly lacks. She can spend more money in 30 minutes than I make in a week. I am probably exaggerating a bit here, but the concern still exists regardless.Obviously, I'm learning to better handle my expenses, but at the same time, I want to spend quality time with my girlfriend. Not spending money is a little far-fetched, but I came up with some ways that you can save money on those ever-growing relationship expenditures.

1. Red Box - This little thing was the best invention of the new millennium. Aside from their convenient locations, they offer the best deal for movie rentals available. While you are at the grocery store (saving money cause you're not eating out), you can stop by these wonderful machines and get new rental DVDs for just a dollar a night. Coupled with a cool recipe, you've got yourself a cheap dinner and a movie.

2. Local Attractions - Nearly every city has somewhere for you to go and take a walk or browse for free. If you can get past the gas prices, you can find cheap accommodations in your back yard. Not to mention how caring and thoughtful your girlfriend will consider you for making the suggestions. I'm from the DC metropolitan area, so we have monuments and museums at our fingertips to (freely) explore.

3. Just above fast food restaurants - If you must eat out, consider your options. I don't know about all girls, but my girlfriend is just as happy eating at Chipotle, as she would be eating at Ruby Tuesdays. Find restaurants where you serve yourself, like Panera Bread or Noodles and Company. These are great places that are a little better than fast food, but not as pricey as a dine-in restaurant. Budget right and save the nicer restaurants for special occasions. Not only will you save money, but then your special occasions are actually "special".

4. DVR - If you have cable, I'd suggest a DVR box. I'm not a huge TV-buff, but having shows, that both my girlfriend and I can tolerate, readily available helps for us to find a common ground when we stay in the house. And the more time we spend in doors, the less money is needed.

5. Video Games - I know this sounds weird, but finding a game that both you and her can enjoy leads to hours and hours of entertainment. I spent $100 on Rock Band, but we've spent a countless number of hours playing it together on the weekends with friends, when we could be out spending money at bars.

6. Drink in - At our age, we still go out regularly. Although, I'm usually the Designated Driver, I'd suggest that if you are going to drink, drink in. You can mix drinks at your house, and a drink that would've costs you $12 can now cost you $3.

Whatever you do, the most important part of the process is communicating to your partner what your financial goals are so that you can work together toward the cause. If you just use a little creativity, you can still have a very spicy relationship without spending as much on it.

Labels:

relationships,

saving

Sunday, November 9, 2008

Greed - Man's Everlasting Quest

I'm not an extremely religious man, but recently I've decided to start attending services with my mother, in order to spend more time with her and the rest of my family. Usually I daze in and out, waiting for the service to come to an end, but today something caught my attention. Today someone got on stage and mentioned a quote that hit me hard. I don't recall it verbatim, but it went something like this, "Man is so greedy, that God is is not enough." It would take many conversations to explain, but I understood this quote as "Man is so greedy, that his own mind is not enough to satisfy him."

The power of the mind is extreme and infinite, yet man is still in search of more. Man wants to control not only his own wants and desires, but he also strives to expand that control to the minds of others. Ego plays an enormous role in the actions of a greedy mind. It's not that the greedy mind wants or needs nice things, but he wants, or feels the need, to have nicER things than others. I want a bigger house, faster cars, and more money than my counterparts. I want to know that I survive better than my peers. These greedy feelings are bred deep within my being, and it makes me wonder if these feelings lay naturally among everyone or if this is unique to me.

The power of the mind is extreme and infinite, yet man is still in search of more. Man wants to control not only his own wants and desires, but he also strives to expand that control to the minds of others. Ego plays an enormous role in the actions of a greedy mind. It's not that the greedy mind wants or needs nice things, but he wants, or feels the need, to have nicER things than others. I want a bigger house, faster cars, and more money than my counterparts. I want to know that I survive better than my peers. These greedy feelings are bred deep within my being, and it makes me wonder if these feelings lay naturally among everyone or if this is unique to me.

Labels:

greed

Subscribe to:

Posts (Atom)